Tax and Discount for commission calculation in Opencart Multi Vendor

Any time customers purchase order from any vendor on Purpletree Opencart Multi-Vendor Marketplace. The admin will earn commission deductions as per set in settings for each purchase that the buyer makes. The balance is released to the seller through the administrator after deducting the commission as decided earlier by offline, Paypal or Paypal payout method. When seller and admin order status is completed then commission will calculate.

In coupon, you can set the coupon code while a customer buying any product he will get the price to deduct as per set in the coupon, coupon can be fixed value or percentage as per set in opencart admin. Tax is a compulsory financial charge or some other type of cost imposed on taxpayers by the government. Discount is a reduction of the normal price for goods. A store that focuses on selling products at below the actual price. We are describing when in order say the discount coupon is applied, a coupon is applied, or tax then how it affects the commission calculating the base amount.

(To see more details of Bestselling Purpletree Opencart Multi Vendor Marketplace, please click here.)

Coupon

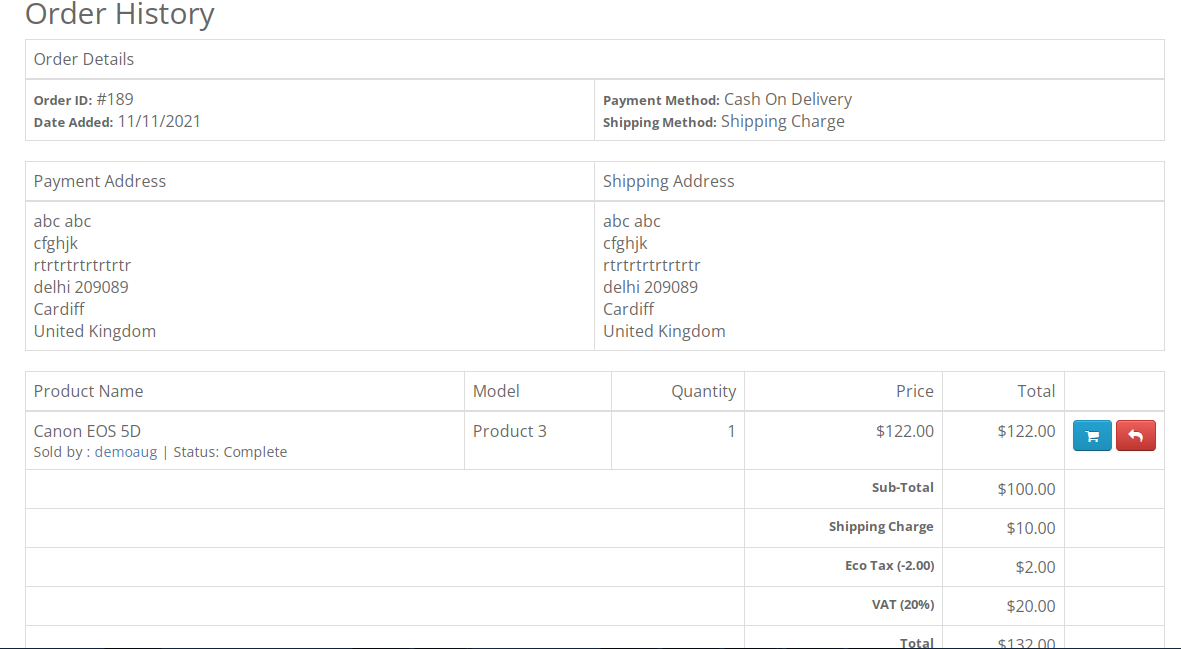

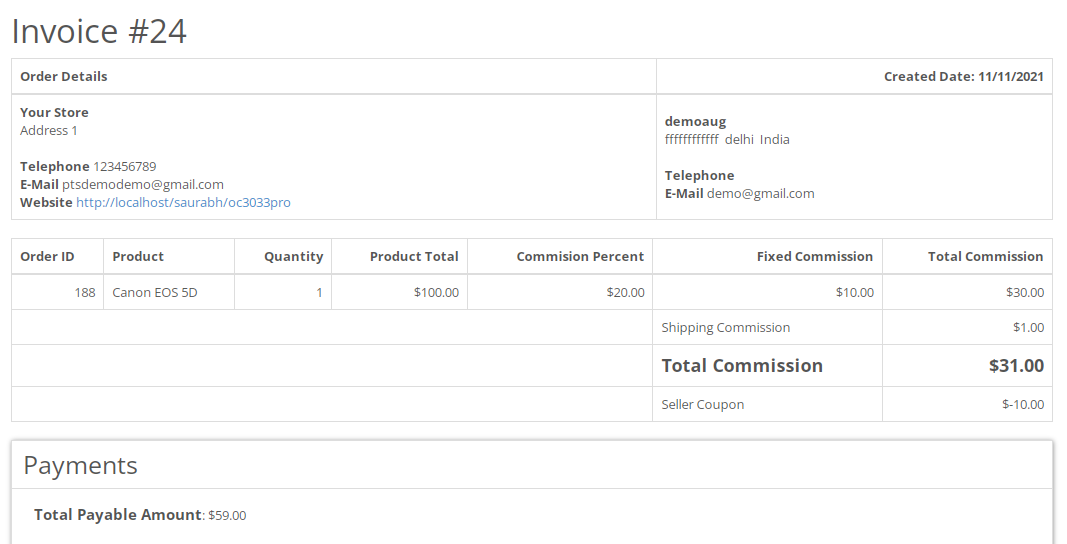

In coupon the commission is calculated on the actual price of the product. Admin can provide commissions to sellers like-Seller commission, Shipping commission, Fixed commission, Commission(per product sale). When seller and admin order status is completed then commission will calculate. If a coupon code is set while the customer buys the product then the customer can get a discount when applying the coupon.

So, if a coupon is applied on order the commission will be calculated on the actual price before applying the coupon.

Tax

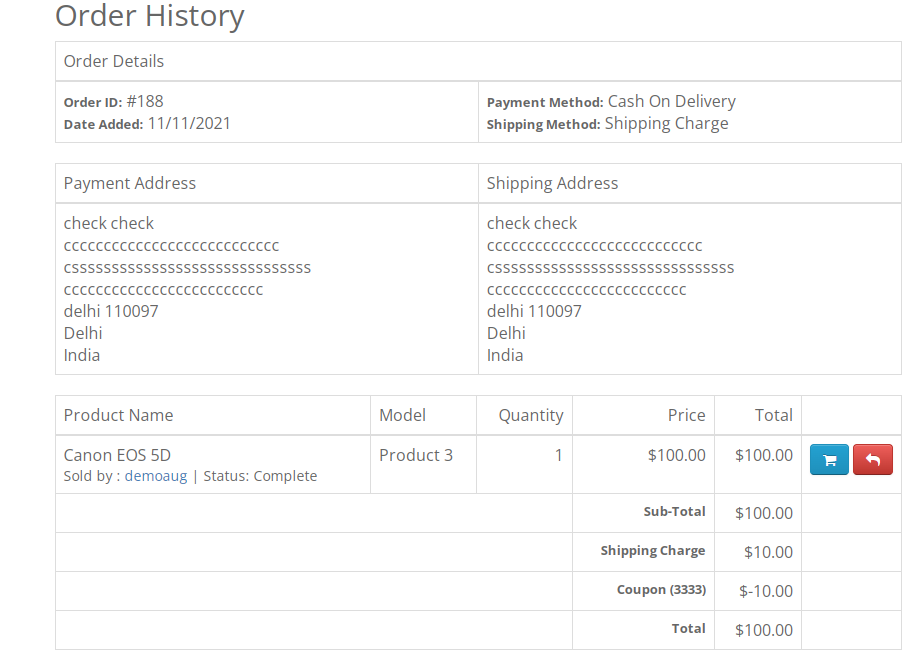

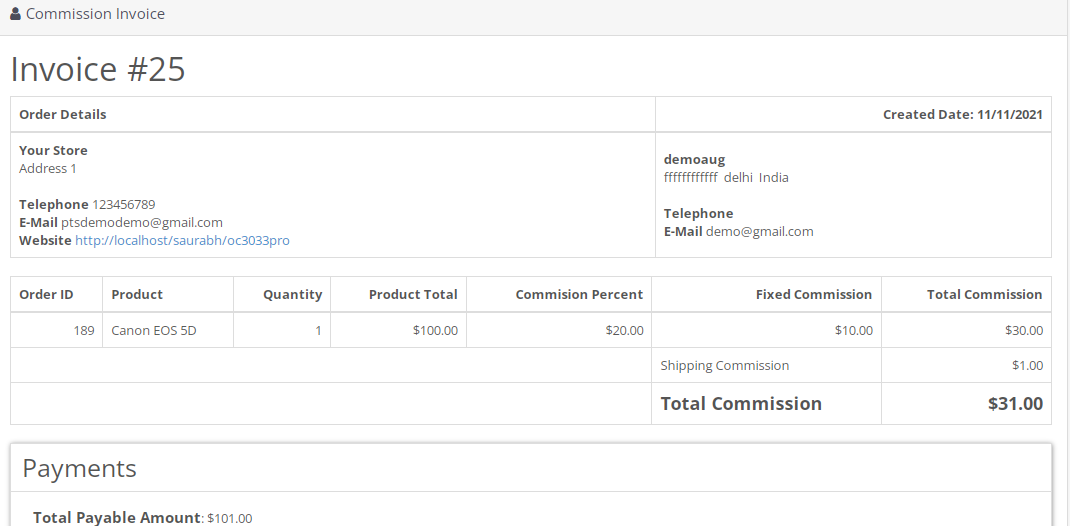

When applying tax then the commission will calculate the actual price of the product. Admin can provide commissions to sellers like-Seller commission, Shipping commission, Fixed commission, Commission(per product sale). When seller order status and admin order status is completed then the commission will calculate. A name for the tax will be displayed on the store front when taxes are added to the order total. Tax is a compulsory financial charge imposed on taxpayers by the government applicable.

So, we can see commission calculation amount does not include the tax in it, commission is calculated on the amount excluding the Tax.

Discount

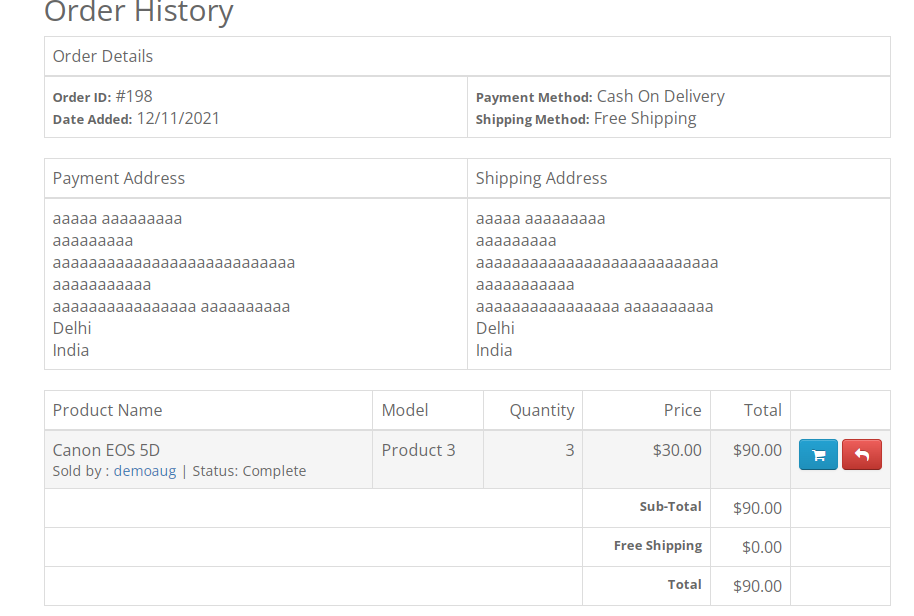

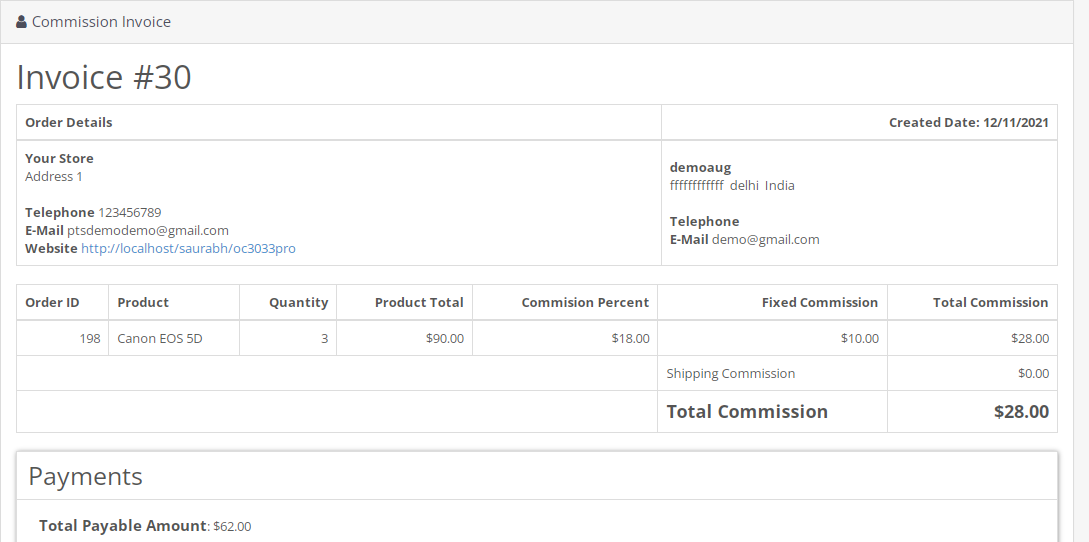

In Discount, the commission is calculated on discounted price. If you apply a discount on the product there is the quantity you can set the limit for the number of products that can apply the discount. On the front side show the discounted price. If customers buy a product then discounts on the product which is limit the amount for the product set according to the discount. If set the quantity limit follow while purchasing the product then a discount will apply otherwise not. Discount is a reduction of the normal price for the goods. A store that focuses on selling products at below the actual price.

We can see the costing of the product remains 90 for 3 items which were 300, so the commission is calculated on discount price or amount.